What is the DOD Trusted Capital Program?

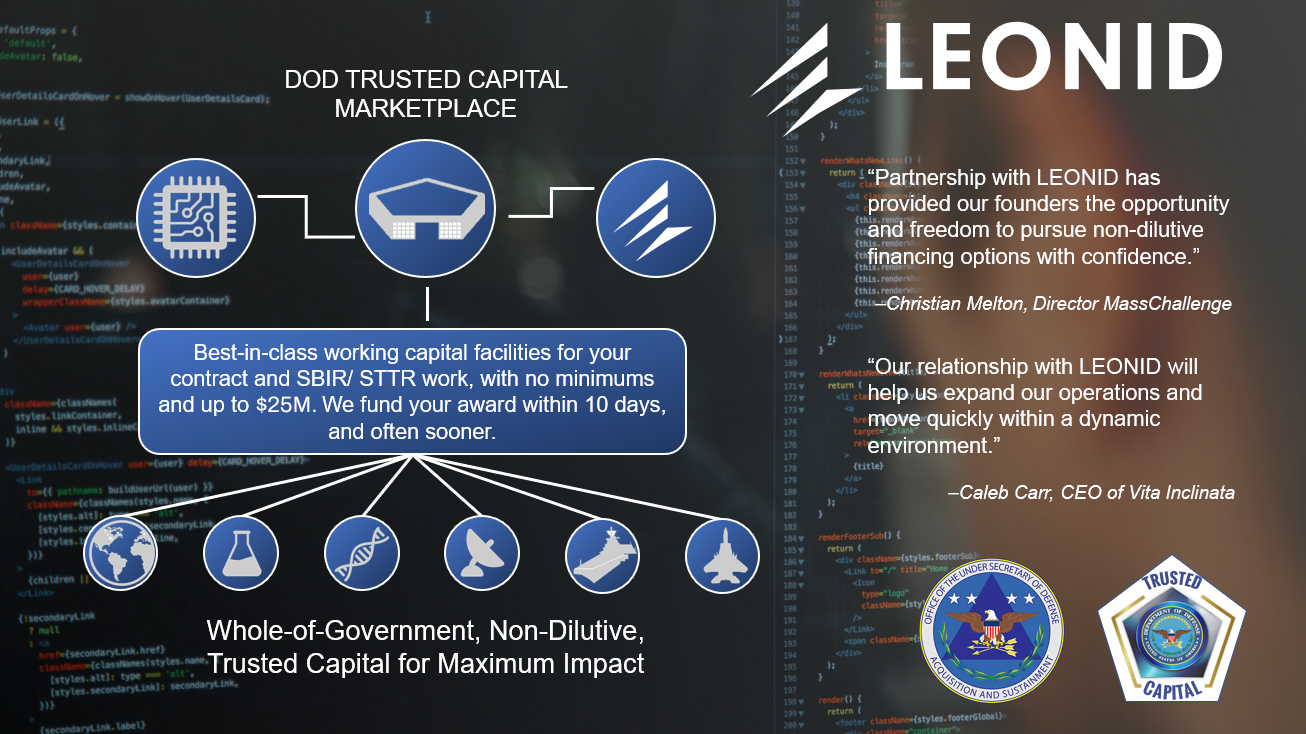

LEONID, established in 2019, is a financial services company and a proud member of the Department of Defense Trusted Capital Marketplace. The DoD Trusted Capital Marketplace helps by allowing trusted sources of private capital to connect with innovative domestic companies that have been previously down-selected by their DoD partners and operate in emerging technology sectors critical to the U.S. defense industrial base.

At LEONID, we take pride in being a Government Trusted Capital Provider that partners with business start-ups, Minority and Women-Owned Businesses, and small and medium-sized businesses to strengthen patriotic entrepreneurs with critical financial services. In addition, we employ strategic non-dilutive capital to ensure you have access to the working capital that helps increase the capability to support DoD needs.

Our Trusted Capital Partner Program offers non-dilutive True Government Contract Financing that not only helps your business to grow but also enables the fulfillment of government contracts. Here’s a detailed overview of what the U.S. Department of Defense (DoD) Trusted Capital Program is, including the major active participants of the Trusted Capital Marketplace, benefits, advantages of working with LEONID, and any other details you might want to know.

What is the US Department of Defense (DoD) Trusted Capital Program?

The DoD Trusted Capital Program is a program established by the Department of Defense to connect companies crucial to the industrial base of the Department of Defense with verified and vetted capital providers with the aim of funding at essential development stages.

Without the Trusted Capital Program, most of the capability providers in the United States DoD supply chain would become susceptible to funding from adverse governments (often surreptitiously), which could significantly affect the transfer of technology.

Trusted Capital Marketplace and The Major Participants.

The U.S. DoD Trusted Capital Marketplace is a platform that connects all the trusted private capital sources and connects them with innovative domestic companies. In most instances, these companies have been down-selected by the Department of Defense and operate in emerging technology sectors critical to the U.S. defense industrial base. Therefore, the Trusted Capital Marketplace is vital in strengthening the domestic manufacturing initiatives by limiting foreign access to critical technology. Some of the active participants of Trusted Capital Marketplace include the following:

- AFWERX

- Army Futures Command

- Defense Innovation Unit

- Joint Artificial Intelligence Centre

- NavalX

- U.S Special Operations Command.

What is a Capability Provider?

Capability providers are companies that specialize in developing and providing products and services in different key sectors and subsectors of technology. Such companies provide critical capabilities, have been down-selected by military services or the U.S. Department of Defense innovation programs, and have been included in the Trusted Capital Program, hoping to raise additional investment funding for vulnerable innovative companies to facilitate economic growth.

In 2018, the National Defense Strategy (NDS) called for the Department of Defense to help strengthen the military advantage in the country by focusing on establishing three lines of effort, including lethality, partnerships, and reformation. In response to this call, the Trusted Capital Program was established and aligned with the NDS and stipulated the following:

- That Trusted Capital Marketplace should increase Lethality.

- That innovation tours be established with the industry to help in building partnerships.

- That incentive for capital providers is established to support various reform programs established by the Department of Defense.

The primary line of effort of the Trusted Capital program was to help cultivate new partnerships with the private sector and facilitate the provision of opportunities for innovation, efficiency, and implementation of lethal force that would help the industry achieve a desired competitive edge.

For businesses to participate in the DoD Trusted Capital Program, certain conditions and prerequisites must be met. First, the capability provider must be down-selected by a DoD Military Service. After the down selection, the company is allowed to apply to the Trusted Capital Program and is allowed to provide a link that can be used to access the online Trusted Capital application portal.

What does it Mean for Businesses?

Working with capability providers means a lot for businesses. The start-ups, Minority or Women-Owned and Service-disabled veteran-owned small Businesses, and small and medium-sized businesses obtain a lot of peace of mind when partnering with vetted sources of strategic capital. Through such partnership programs, these businesses get funding to offset their payroll obligations, pay for equipment and vendors to help them in servicing their government contracts.

As companies are made up of professionals in their respective fields of study, the capability providers also help these small businesses achieve their strategic plans by effectively identifying business gaps and working out effective strategies to achieve the identified gaps. In addition, the capability providers are also known for providing these businesses with informed and intelligent business decisions regarding how to get the trusted fund programs and use them effectively for business sustainability and growth.

Benefits of Working with a DoD Trusted Capital Provider

The primary aim of establishing the Trusted Capital program was to reduce the risk of critical and advanced technology being acquired by adversaries and to ensure that innovation is fostered among the businesses that require investments. This means a sense of protection to the businesses in the country through risk reduction and capital funding.

Working with DoD Trusted Capital providers also means working with vetted capital partners who have undergone a comprehensive screening process conducted by the national security to lessen the risk of transactions drawing scrutiny from the U.S. regulators in the context of foreign investment reviews. The Trusted Capital providers also ensure that the capital advanced to businesses across the country is pre-screened to prevent the risk of undermining national security in such processes.

Working with trusted capital providers also enables the businesses to get opportunities for exploring mutually beneficial partnerships that help support national security goals. This ensures economic growth, which benefits all the partners in an economy.

Advantages of Working with LEONID

LEONID is a DoD Trusted Capital Provider that offers non-dilutive capital to businesses and enables you to control your business on your terms. Working with LEONID gives businesses lots of advantages ranging from the efficiency of transactions to the full realization of the financial obligation for a particular investment desired by the business.

As changemakers in the capital provision and business funding, LEONID remains committed to providing trusted access to capital needed by small businesses to help them in fulfilling government contracts. This is achieved through a mission-oriented funding program that provides maximum impact for the companies.

Our mission-oriented funding program helps businesses partner with innovators in the capital funding industry to deliver highly technical solutions that help them propel their social and economic progress in different aspects, like national intelligence, aerospace, defense, and cybersecurity. The company also helps fund government projects and ensure that the best is brought out for the collective future of the businesses.

Our Government Contract Financing Program

LEONID launched the 1st true government contract financing program in which the company can finance a government contract before the work has started or buy the unpaid government invoice with a non-dilutive strategy to help deliver the business capital exactly when needed. This has increased efficiency in terms of capital access to the businesses enabling them to realize their strategic goals without much stress of going through the tedious process of accessing the capital.

We understand government contractors’ needs and focus on maximizing your experience as a customer. Most of the government contracts require fast access to working capital to be fulfilled. However, due to bureaucracy and the long payment cycles involved, it may be extremely difficult for business owners to receive a completed and paid invoice. This is where LEONID Finance comes in very quickly to secure a capital cash flow for you.

By using the company’s trusted government contract financing model, all mission-oriented visionaries and investors can access the very best technology to enable your ultimate protection and that of the entire country. The company is devoted to ensuring customers get a better, simple cutting-edge government contract by keeping the required capital.

Lastly, LEONID has flexible government contact financing options that allow all levels of business owners to fund their government projects regardless of their financial status. Some of the best financing programs offered by the company include government contract financing, government invoice factoring, and SBIR financing that helps businesses to secure working capital facilities for SBIR awards with no minimums, invoice financing which provides a one-time advanced capital funding up to 90% of the contract cost, and STTR financing program which helps businesses to secure working capital facilities for Small Business Technology Transfers. Some clients we have satisfactorily served include the Justice Solutions Group, Litocorp, AguaCulture Technologies, and CBio.

Contact us today for capital funding and financing for your Government Contract or SBIR STTR Grant.